The Smarter, Faster, Dreamier Home Search.

With Wahi, your perfect home finds you.

Property type

Detached

Semi Detached

Condo

Townhouse

Land

Other

Bedrooms

Exclude den and basement’ means that any den or basement bedrooms is not counted in the property’s total listed area.

Bathrooms

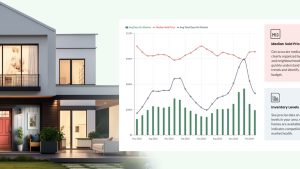

Great REALTORS®. Modern Tools. A Smarter Experience.

Get full-service support from a Wahi Select Realtor in your area — powered by data, driven by results.

As Featured In:

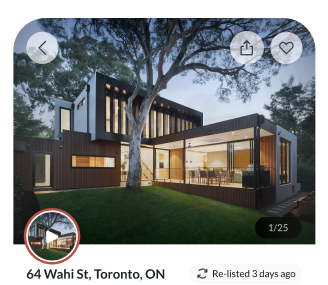

Homes for Sale

Just Listed in TorontoView all

Open Houses in TorontoView all

Just Sold in TorontoView all

Price Decreased in TorontoView all

Homes near top schools in TorontoView all

Discover Nearby Homes in TorontoView all

What Customers Are Saying:

Overall Google Review Rating

4.8/5

The smarter way to buy and sell a home.

Join thousands who love Wahi!

Download the Wahi app