One of Ontario’s Least Affordable Housing Markets is in Kitchener-Waterloo

To afford a median-priced home in the former village of Doon, Ont., now a part of Kitchener, you need a household income of $250,000, according to Wahi.

By Josh Sherman | 3 minute read

With a booming tech industry and multiple campuses, Kitchener-Waterloo has become one of the priciest housing markets in the province.

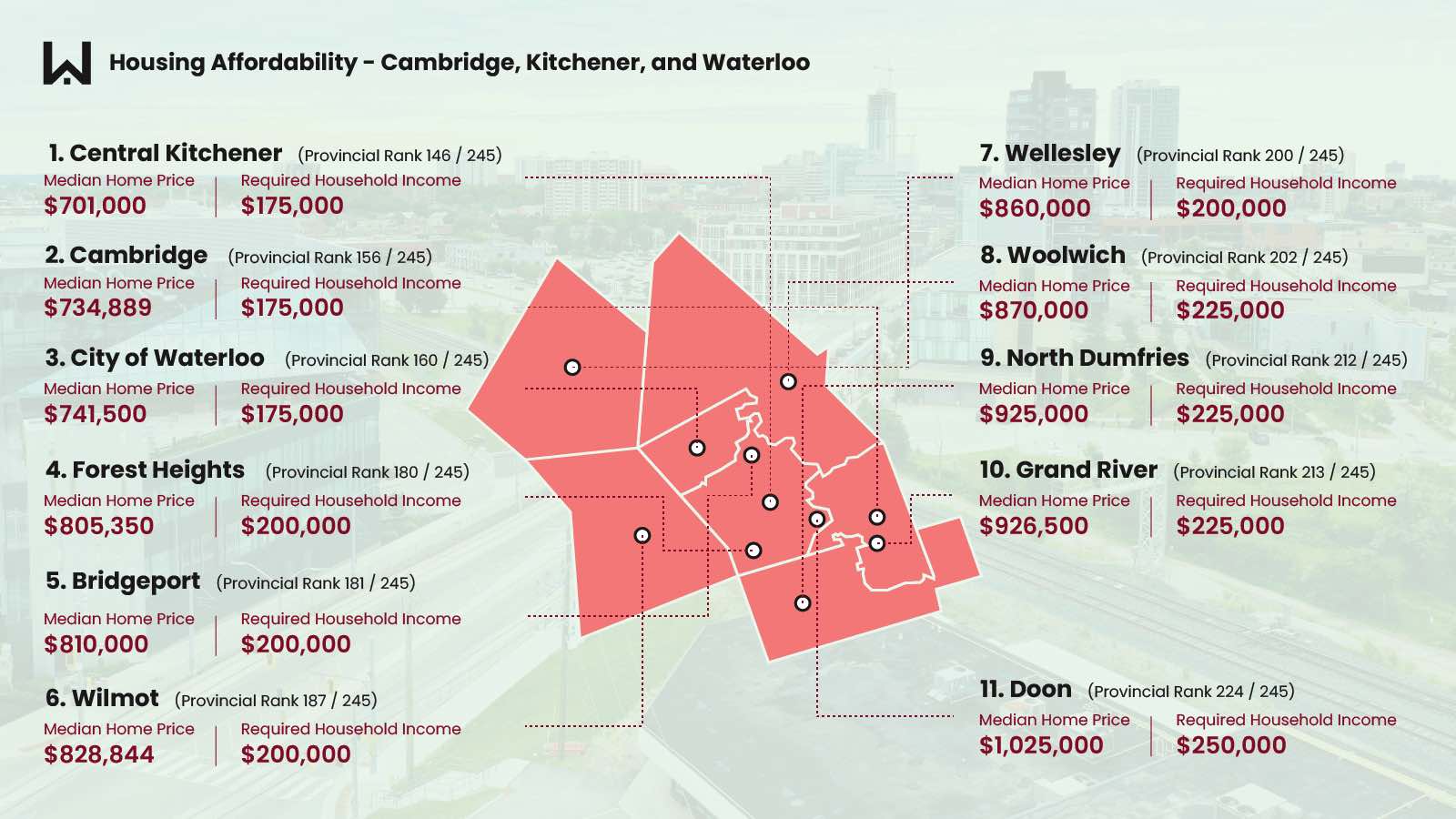

The Cambridge, Kitchener, and Waterloo area is home to one of the province’s most expensive local housing markets, according to a new report from Wahi.

The report is based on Wahi’s Roadmap to Housing Affordability: Ontario Edition, which is an interactive tool that shows potential homebuyers where they can potentially afford to live. Results vary depending on household earnings and local home prices in 245 local real estate markets, including about 50 cities around the province as well as many towns and villages.

According to Wahi’s calculations, Doon, a suburban community within the city of Kitchener, is the priciest in Cambridge, Kitchener, Waterloo area. It is also the 22nd most expensive in the entire province. With a median home price of $1,025,000, Doon requires households to earn a combined pre-tax income of $250,000 to afford a home. The maximum affordable monthly mortgage payments at that income level work out to $5,200. Here’s how Doon compares to the rest of the region, which is comprised of 11 local housing markets (the bigger the number, the less affordable the market):

Each local market comprises multiple neighbourhoods. For example, Doon includes Doon South and Lower Doon, while Central Kitchener encompasses the majority of the city’s more than 40 neighbourhoods, such as Cherry Hill, Westmount, and more.

How Wahi Calculates Affordability

To use Wahi’s Roadmap to Housing Affordability, homebuyers first enter their household income. The tool then populates a map that highlights local markets where the median home price is affordable, based on a few assumptions. Wahi assumes a 20% downpayment, a mortgage rate of 5.24% (provided by Rocket Mortgage as of July 14), and a 25-year amortization period. To meet the affordability threshold, households shouldn’t be spending more than 25% of their pre-tax income on monthly mortgage payments.

Home price data is from the first quarter of this year. Median home prices include all housing types. Places where there were fewer than 50 transactions in the first three months of the year were excluded from calculations. (Note that calculations also don’t take into account savings, help from relatives, or other factors that may help a household purchase a home.)

We put the real back in real estate.

Join Wahi today and find out how easy it is to get real estate in Canada.

Wahi’s Roadmap to Housing Affordability Highlights Housing Challenges — and Opportunities

The affordability challenges in Cambridge, Kitchener, Waterloo are not unique to the region. Provincewide, just 19 out of 245 local real estate markets are affordable for households earning the average income of about $100,000. “The fact that only a handful of cities — mostly small — are affordable to households with even above-average earnings truly highlights Ontario’s affordability crisis,” says Wahi CEO Benjy Katchen. “However, the new Roadmap to Housing Affordability also puts the spotlight on local housing markets that homebuyers might not have thought about considering before,” he adds.

Just because the median home price is unattainable at a given income level, it doesn’t mean homebuyers should give up searching. The median home price is the middle number among all transactions, meaning half of the Doon’s homes sold for less than $1,025,000, for example. Once you’ve determined your maximum budget by using the Roadmap to Housing Affordability, you can then scan Wahi listings to view properties at lower price points.

Other Roadmap to Affordability: Ontario Edition Highlights:

- King, in York, is Ontario’s least affordable housing market with a median home price of $1,785,888 and required household income of $425,000

- Deep River, a five-hour drive from Toronto, is the most affordable Ontario market with a median home price of $322,250 and required income of $75,000

- North Bay is the only affordable city for homebuyers with an average household income

Curious to see which parts of the province are within your homebuying budget? Check out Wahi’s Roadmap to Housing Affordability: Ontario Edition.

Josh Sherman

Wahi Writer

Become a Real

Estate Know-It-All

Get the weekly email that will give you everything you need to be a real estate rockstar. Stay informed and get so in the know.

Yes, I want to get the latest real estate news, insights, home value

estimates emailed to my inbox. I can unsubscribe at any time.