How Low Will Ontario Home Prices Go?

It comes down to location, but the provincewide average home price is forecast to plunge 25% from last year’s peak before the market settles, according to a recent report.

By Josh Sherman | 4 minute read

The local markets that saw the most rapidly increasing home prices during the pandemic are anticipated to face the sharpest corrections, some economists say.

Ontario looks to be facing the harshest post-pandemic real estate correction of any province, but home prices in most local markets should stop collapsing before the year’s end, according to a recent real estate forecast.

In its Ontario Housing Market Outlook report, Desjardins forecasts the average price of an Ontario home, including condos and houses, will finish the year down 25% from the peak in February 2022, when the average reached $1,081,598. “We’re likely to see the bottom towards the end of this year,” Marc Desormeaux, Desjardins principal economist and co-author of the report, tells Wahi.

“We’re still working our way through the impacts of higher interest rates and the slowdown in the economy.”

Ontario’s sharp decline beats out BC, where prices are anticipated to wind up 22% less than their former peak by year’s end, and Prince Edward Island, which is forecast to end its tumble with prices 21% lower over the same period. Projected declines in all other provinces range from nearly flat at 2% to 16%:

- Alberta (-7%)

- BC (-22%)

- Manitoba (-6%)

- New Brunswick (-15%)

- Newfoundland (-7%)

- Nova Scotia (-12%)

- Ontario (-25%)

- Prince Edward Island (-21%)

- Quebec (-16%)

- Saskatchewan (-2%)

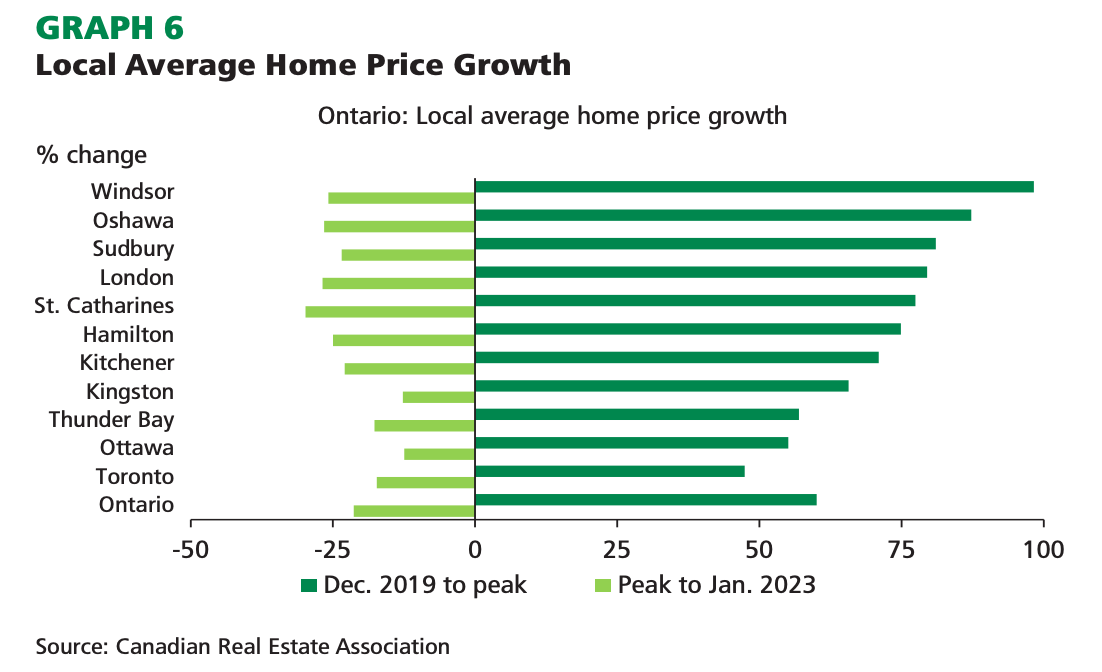

Within Ontario, price drops are going to vary by local market. Generally, how quickly home prices in cities and towns increased before the correction began last spring — when the Bank of Canada started hiking interest rates — is expected to have a major influence on how far home values end up falling in these places. “Fundamentally, all housing is local,” according to the report. “It’s a well-worn cliché that real estate comes down to location, location, location.”

Location, Location, Location

“We think that in an environment of price normalization that the cities that saw the biggest runup during the pandemic — they’re the ones that are going to see the most significant decline from peak to trough,” Desormeaux explains. In certain of these locations, Desormeaux warns, home prices may not find a bottom this year: “There’s some potential it could take a little bit longer — in some of the cities that did see that runup — to reach the bottom.”

The dynamic represents the reversal of a trend that took root in Ontario under lockdown. “The broader thing here is the shift in homeowner preferences during the pandemic,” the Desjardins economist notes. “There was an ability to work remotely, so homes that were farther away from the city centre — where most working arrangements were — were suddenly available as options.”

Smaller-town properties often had room for home offices and satisfied people’s desire for private and safe outdoor space at a time when public parks and attractions were closed. That contributed to massive price gains in secondary and tertiary markets. “During the pandemic, for instance, some of the runups in prices were really astounding, like you look at a place like Parry Sound, for instance, which saw a 138% increase from December 2019 to its peak in early 2022, which is just an enormous increase,” says Desormeaux. During that time, Toronto prices soared 48%, while North Bay’s doubled and increases in northern Ontario markets of Sudbury and Sault Ste. Marie approached 80%.

However, with more Ontarians returning to the office, the trend is reversing — and with it, so are home prices. “That’s really the broader trend that’s driving this, in our view, alongside just affordability impacts and, of course, higher interest rates,” says the Desjardins economist.

The Upshot

Because price gains were so exuberant until spring last year, the ongoing correction isn’t likely to be enough to erase all of the pandemic runup — not by a long shot. “We still expect that by the end of this year, home prices will be fairly high above where they were in December 2019,” says Desormeaux. “We’re still working our way through the impacts of higher interest rates and the slowdown in the economy,” he adds.

“For some markets, there may be a more significant percentage correction — they might be closer to where they were in 2019 — but broadly speaking we don’t think that all of the pandemic gains will go away by the end of this year.”

We put the real back in real estate.

Join Wahi today and find out how easy it is to get real estate in Canada.

Avoiding a return to pre-pandemic prices is good news for homeowners. But it also underscores the importance of addressing the affordability crisis by building more homes across the province, not just in major cities, a finding echoed by a new report from Toronto Metropolitan University’s Centre for Urban Research and Land Development. “One of the key takeaways here is that this isn’t just a big-city challenge,” says Desormeaux. “There’s going to need to be new homes built in smaller centres over the coming years, otherwise affordability risks becoming an even more significant challenge.”

Josh Sherman

Wahi Writer

Become a Real

Estate Know-It-All

Get the weekly email that will give you everything you need to be a real estate rockstar. Stay informed and get so in the know.

Yes, I want to get the latest real estate news, insights, home value

estimates emailed to my inbox. I can unsubscribe at any time.