The Smarter, Faster, Dreamier Home Search.

With Wahi, your perfect home finds you.

Property type

Detached

Semi Detached

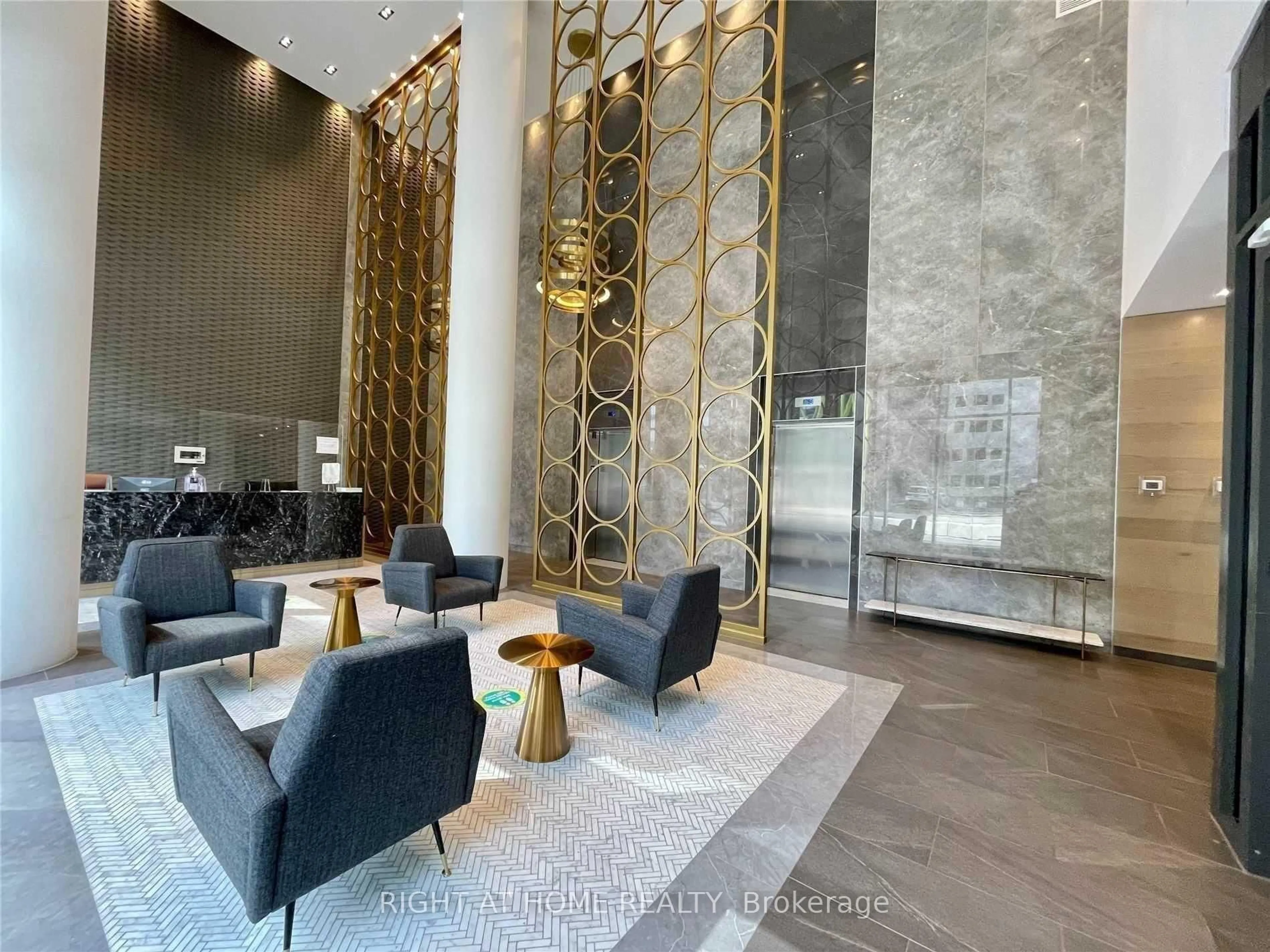

Condo

Townhouse

Land

Other

Bedrooms

Exclude den and basement’ means that any den or basement bedrooms is not counted in the property’s total listed area.

Bathrooms

Great REALTORS®. Modern Tools. A Smarter Experience.

Get full-service support from a Wahi Select Realtor in your area — powered by data, driven by results.

As Featured In:

Homes for Sale

What Customers Are Saying:

Overall Google Review Rating

4.8/5

The smarter way to buy and sell a home.

Join thousands who love Wahi!

Download the Wahi app