Overbidding Surge Intensifies in the GTA Housing Market

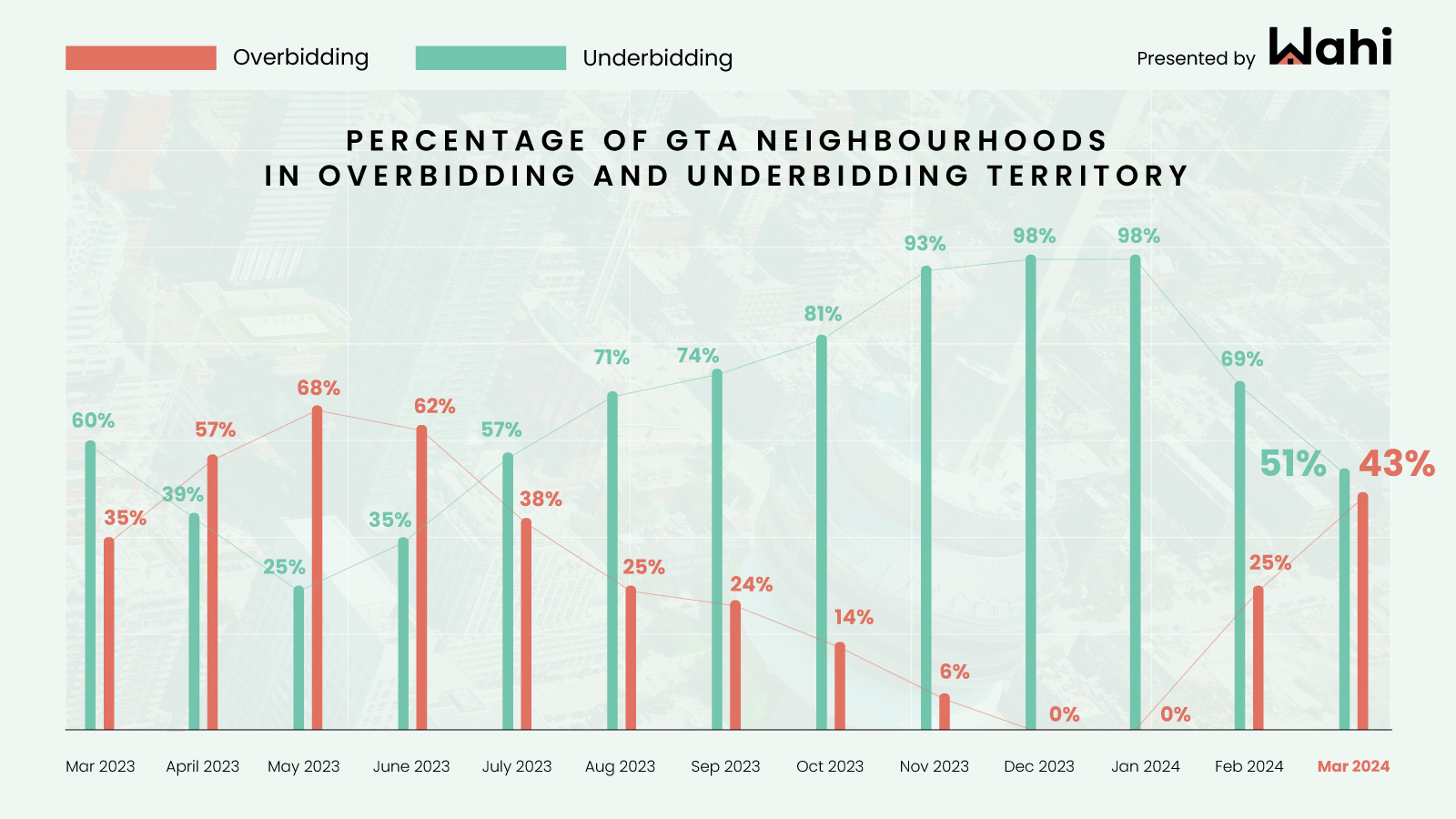

About 43% of Greater Toronto Area neighbourhoods were in overbidding territory in March, up sharply from 25% in February, according to Wahi analysis.

By Josh Sherman | 2 minute read

The share of overbidding neighbourhoods has once again surged month-over-month, but some homes continue to sell below asking price, depending on the area and housing type.

The wave of overbidding that suddenly struck the Greater Toronto Area’s housing market in February crested higher in March with the arrival of the spring selling season, according to Wahi’s latest monthly Market Pulse Report.

In March, 43% of GTA neighbourhoods were in overbidding territory, compared to 25% in February and 35% from a year ago. An additional 6% were selling at-asking, roughly unchanged month-over-month, and 51% were underbid, down from 69% over the same period. “We’re beginning to see more homebuyers step off the sidelines, resulting in more bidding competition in a growing number of neighbourhoods,” says Wahi CEO Benjy Katchen. “That said, with more than half of the neighbourhoods remaining in underbidding territory, a significant number of buyers still appear to be purchasing homes below-asking, particularly in the condo market,” he continues.

Competition among buyers was especially fierce in the non-condo segment (non-condos are any homes without monthly maintenance fees and generally include detached, semi-detached and row homes as well as many but not all townhouses):

- About 61% of neighbourhoods were in overbidding territory for non-condo homes in March, up from 39% in February, while approximately one third were underbid.

- When looking only at condo sales, just 14% of neighbourhoods were in overbidding territory in March, up from 7% in February, with the vast majority (82%) still underbid. “The condo market may be facing some pricing pressure from new-build condos entering the resale market via assignment sales,” explains Katchen. “As higher interest rates have taken their toll, many units purchased two-to-three years ago are now hitting the market at discounts from the original purchase prices.”

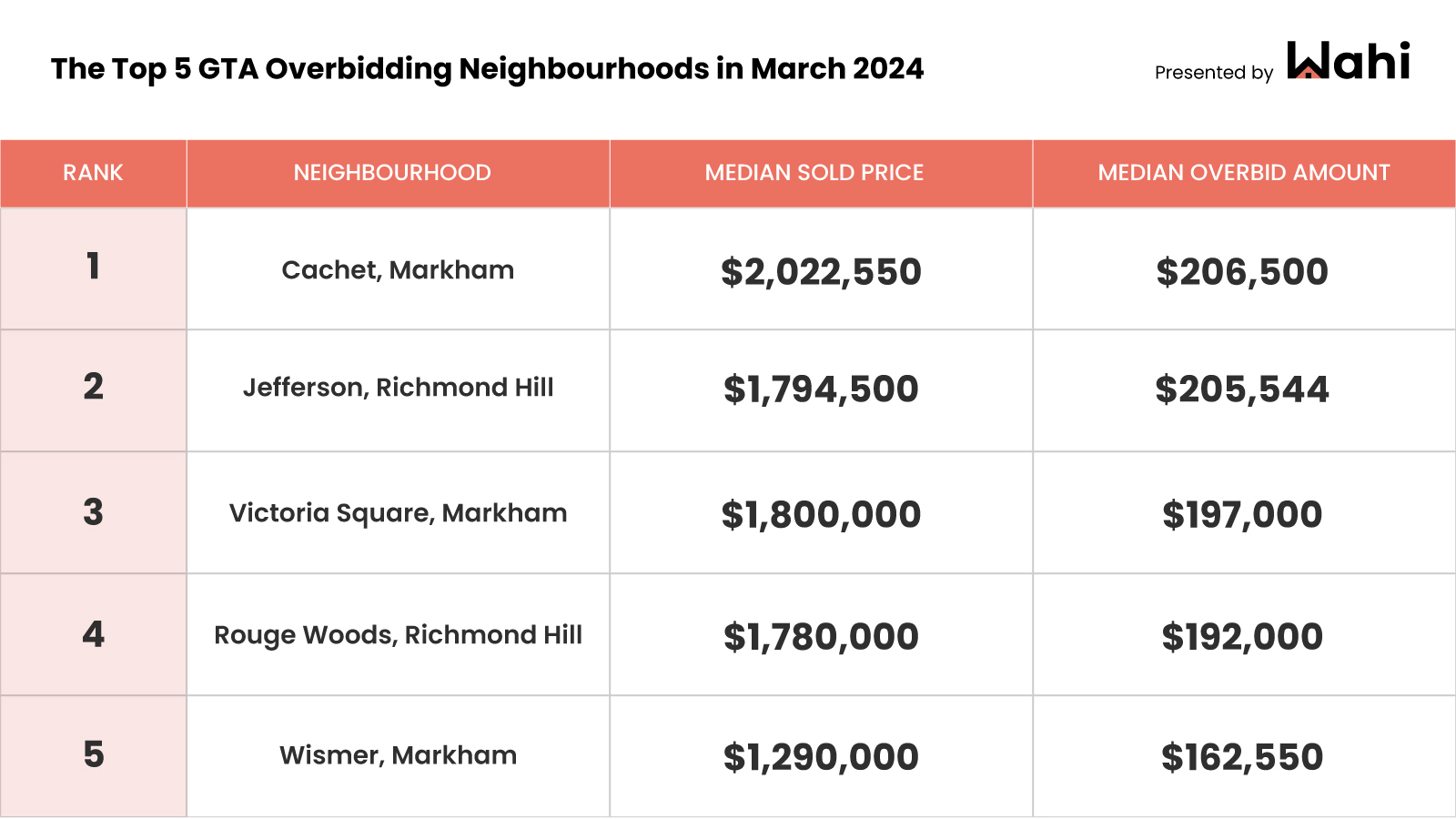

The Top 5 GTA Overbidding Neighbourhoods in March 2024

All of the top five overbidding neighbourhoods were located within the Regional Municipality of York. Note that when a neighbourhood is in overbidding territory, it doesn’t necessarily mean that every home is selling above-asking. Instead, it’s a general reflection of overall market behaviour, which can be influenced by seasonal factors, for example, or decisions by sellers, such as to list homes below market value to try and attract more bids.

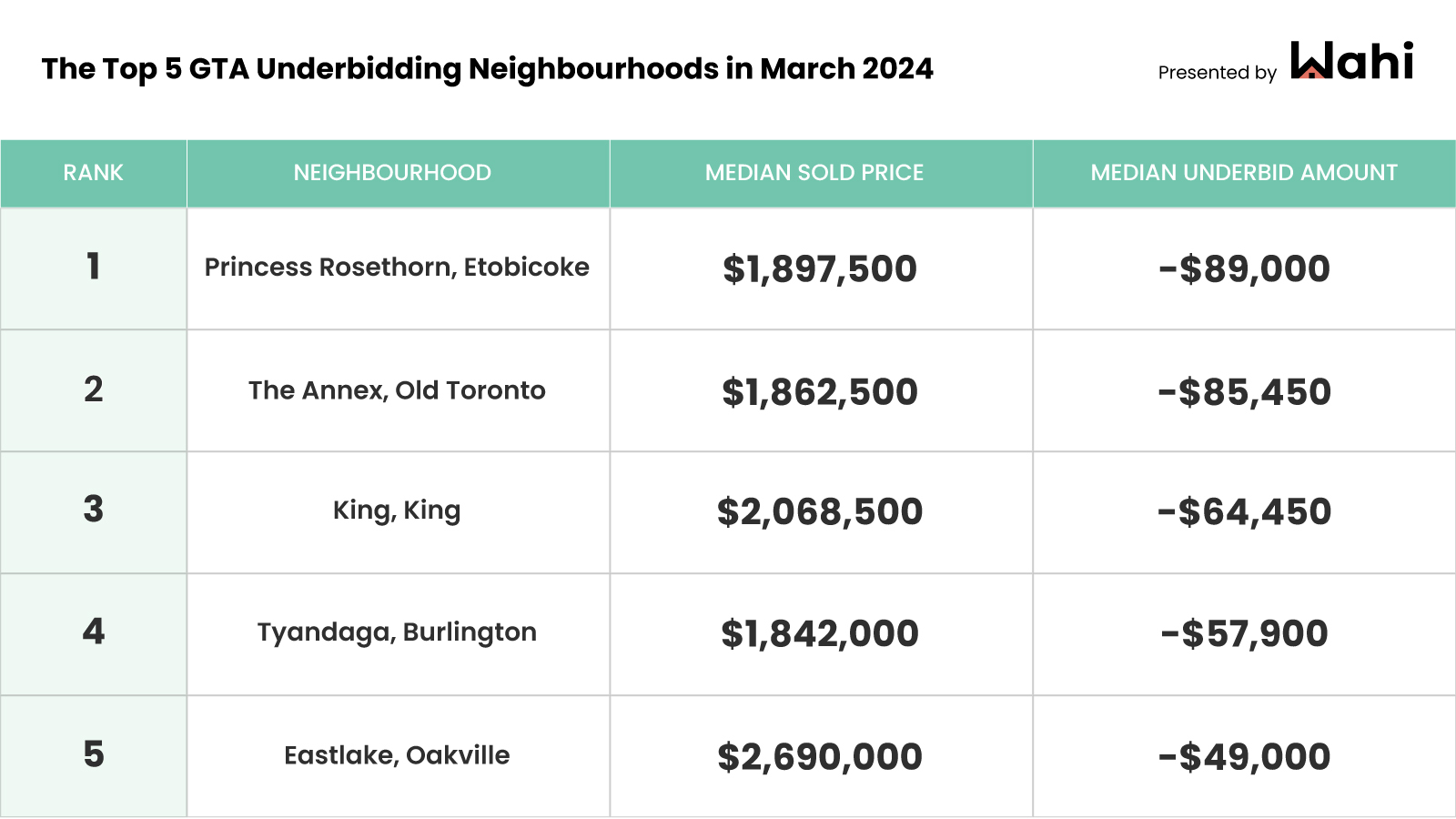

The Top 5 GTA Underbidding Neighbourhoods in March 2024

The top underbidding neighbourhoods were more evenly distributed across the GTA, with neighbourhoods in Toronto and York and Halton regions making the grade. In past months, the region’s most underbid neighbourhoods had tended to be significantly more expensive than the top overbidding neighbourhoods, but the price gaps between the two narrowed in March as we see renewed activity across the price spectrum.

Find the Right REALTOR® for You

We'll match you with a proven agent in your area.

How Wahi Ranks Overbidding and Underbidding Neighbourhoods

At the end of each month, Wahi compares the differences between median list and sold prices to determine whether neighbourhoods are in overbidding or underbidding territory, excluding those neighbourhoods with fewer than five transactions in a given month. A total of 257 neighbourhoods out of the GTA’s approximately 400 met this threshold in March.

The top overbidding and underbidding neighbourhoods are ranked by the median overbid or underbid amount. The median overbid and underbid amounts are calculated by subtracting the list price from the sold price of each individual listing in a given neighbourhood. These are then ranked by the median of all subtractions and presented as the median overbid or underbid amount. For the latest data on overbidding and underbidding at any point in the month, Wahi’s Market Pulse tool provides readings based on the past 30 days of transactions.

Josh Sherman

Wahi Writer

Become a Real

Estate Know-It-All

Get the weekly email that will give you everything you need to be a real estate rockstar. Stay informed and get so in the know.

Yes, I want to get the latest real estate news, insights, home value

estimates emailed to my inbox. I can unsubscribe at any time.