The New Capital Gains Tax, and Rental Payments Now Factored into Credit Scores

Every Friday, Wahi brings you the most important real estate stories from the past week.

New Capital Gains Taxes Spurs Cottage Selling Frenzy

The latest federal budget includes a lot of programs designed to make homeownership more affordable, but buried in the fine print is a tax hike on secondary homes, and it’s already influencing the recreational property market. On June 25, the Capital Gains Inclusion Rate will increase from one-half of the profits on earnings over $250,000, to two-thirds. That means cottage owners who sell their properties for at least a quarter million dollars more than what they paid will see a bigger tax bill, which has inspired a wave of listings as owners seek to sell before the deadline.

“Cottage owners who sell their properties for at least a quarter million dollars more than what they paid will see a bigger tax bill, which has inspired a wave of listings as owners seek to sell before the deadline.”

Equifax Begins to Acknowledge Renters

In its recent budget announcement the Federal Government called on credit agencies to factor rent payments into credit scores, and this week Equifax answered. The agency announced that it’s exploring ways to adopt rental data in its credit scores to help make financial services, and ultimately homeownership, accessible to more Canadians. The change could potentially provide renters with more affordable mortgage rates and help many end the rent cycle. Equifax says it’s testing the new approach to collecting and utilizing rental data in its credit scores in small volumes for now, with the hope of future expansion.

Want a Home? Better Get a Side Hustle

Side hustles used to offer a little extra spending money; now a second job appears necessary just to live in Canada. According to a recent study by RBC, 57% of Canadians would need a side hustle to afford a home, including 75% of newcomers. At the same time the bank says the dream of homeownership remains alive, with 60% saying it’s a good investment, and 29% looking to buy in the next two years — up from 22% last year. Half, however, said inflation has made it more challenging, and 45% admit they will need to change their spending and saving habits.

The GTHA’s Abandoned Construction Projects Pile Up

If the chorus of construction that typically fills Southwestern Ontario seems more muted these days. That’s because 60 condo projects in the greater Toronto and Hamilton area are on hold indefinitely, according to a new report by Urbanation. The study found that only four new projects made it to market in the first quarter of 2024, adding a total of 958 units to the region. At the same time, 21,505 units that were on track to launch by now have been put on ice, due to lackluster sales figures across the region, where unsold inventory is up 124% since 2022.

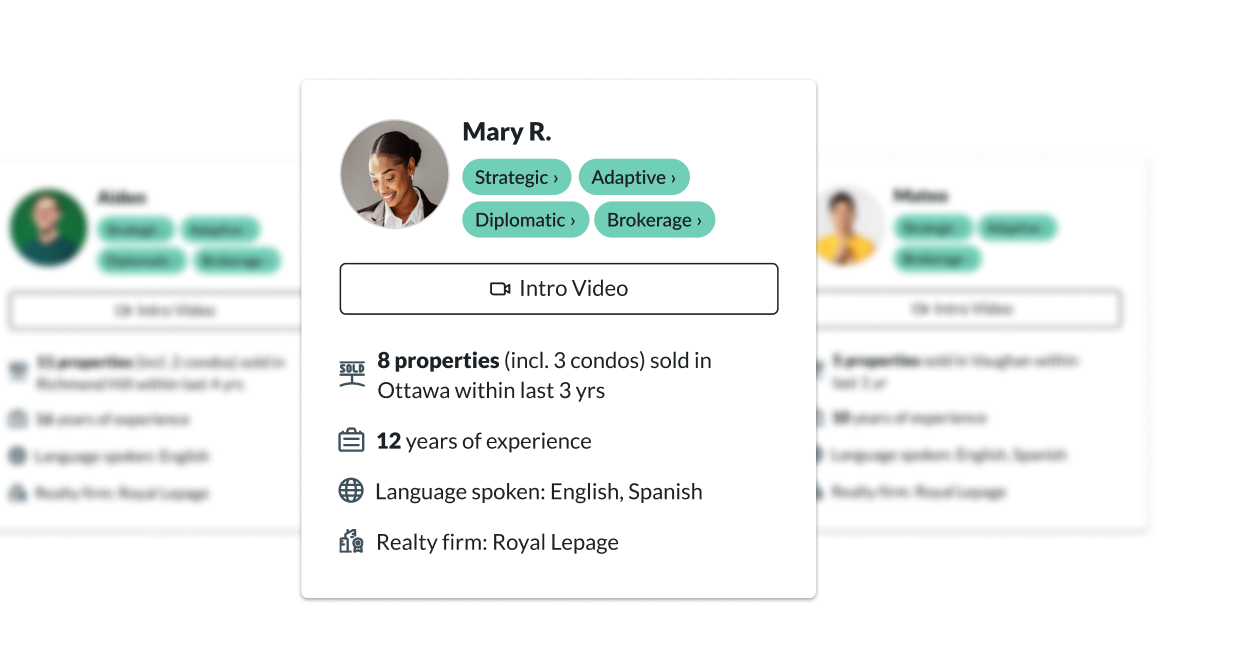

Find the Right REALTOR® for You

We'll match you with a proven agent in your area.

GTA New Home Sales See Third Month of Record Lows

Torontonians always fall for the March mirage, when a few days of warmth inspire them to shed their jackets, open their patios and change their tires just before the next cold front moves in. It appears the housing market played a similar trick. Despite some encouraging signs of an active spring, the market appears frozen again, as the GTA sees its third straight month of record low new home sales, according to a new report by BILD. Only 1,125 new homes sold in the GTA last month, down 16% from last year and 66% below the 10-year average.

Jared Lindzon

Wahi Writer

Share this article on social.

Become a Real

Estate Know-It-All

Get the weekly email that will give you everything you need to be a real estate rockstar. Stay informed and get so in the know.

Yes, I want to get the latest real estate news, insights, home value

estimates emailed to my inbox. I can unsubscribe at any time.